|

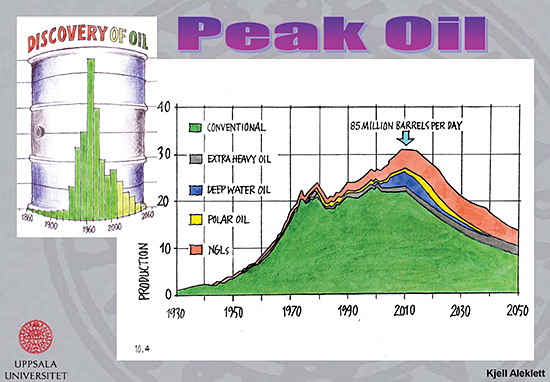

Peak OilSee also: Why Is Peak Oil Such A Serious Problem?, The End of Suburbia (Video), The Power of Community: How Cuba Survived Peak Oil (Video), Why the Global Economy is About to Crash, What To Do About the Upcoming Economic Crash, Arithmetic, Population and Energy (Video). UPDATE: February 2017. I'll go over this page soon and update anything that looks obviously wrong, and add new info from since it was written (about 2012). More recent information (from 2013-2017) agrees that the global peak of conventional oil was around 2005 or not long after that (it was pretty flat for a few years after 2005). The economic crash in 2008 was largely due to this, since the economy must continually grow or crash and we can't have overall economic growth without overall oil supply growth. Tight OilAfter that, production of existing "tight" oil, which is much harder to extract (requiring the use of hydraulic fracturing a.k.a. fracking), was ramped up greatly. Nearly all of this tight oil can also be called shale oil. There is also light tight oil, abbreviated LTO, which basically includes shale oil plus, perhaps, some very minor non-shale-oil contributions. These three (tight oil, shale oil and LTO) can pretty much be thought of as being the same thing. They are included as part of the broader category called unconventional oil. The increased overall oil production (because of tight oil) caused many people, especially those with a vested interest in promoting ongoing economic growth, to claim that peak oil was no longer an issue. However the lifetime of these tight oil wells is very short and is peaking in the late 2010s (or perhaps in 2015). I'll add much more on this soon. The overall effect of this tight oil boom is that the impact of peak oil has been delayed by approximately 10 years. Oil ShaleNote that shale oil (as mentioned above) is a completely different thing to oil shale, which can be confusing: Oil shale is an inorganic rock that contains a solid organic compound known as kerogen. The term “oil shale” is a misnomer because kerogen isn’t crude oil, and the rock holding the kerogen often isn’t even shale. Adding to the confusion, some sources (such as wikipedia) use the term shale oil to mean the (synthetic) oil extracted from oil shale, which is completely different from the fracked tight oil "shale oil" that powered the 2009-201x USA shale oil boom. Oil shale (not shale oil) is another type of unconventional oil. It's more unconventional than tight oil (shale oil), and it's method of production even further removed from the conventional oil well most people are familiar with. Some people claim that oil shale will be the next big thing after tight oil (shale oil) starts to run out, which is going to be pretty soon. Whether or not this is true remains to be seen. The price of oil will have to be quite high for it to be profitable (which is likely to happen eventually). Also the total rate of oil extractable from it must be high enough to make a significant contribution to the world's ever-increasing demand for oil, which may well be impossible (more research to follow). Also its extraction is extremely damaging to the environment, even more than more familiar types of oil. MiscellaneousThere are several graphs going around, usually produced by very large organisations, showing an increase in oil production for the next few decades. When you look further into the individual components of each graph bar, you see things like "oil yet to be developed" and "oil yet to be discovered". This type of thing, especially the"oil yet to be discovered" is basically drawing the graph backwards. A line is drawn on top for the total, showing how much oil the economy will need. And then the area below is filled in first using known sources, and then filling in the remaining gap with anything you can imagine, even oil that does not exist — oil that is not known to exist, and is very probably never going to exist. See also: Brace for the oil, food and financial crash of 2018 and Peak Oil: The Crash Course - Chapter 21 - Shale Oil. [End of February 2017 update so far] What is Peak Oil?All oil production, when drawn on a graph of production versus time, follows an approximately bell-shaped curve, known as "peak oil". That is, oil production initially increases, then peaks, then inevitably and relentlessly declines. This happens in an individual oil well due to the physical properties of oil and how it is stored underground. It also happens to the total production summed over many wells in an oil field, over a whole oil production region, a country, and eventually, to the entire world. The actual "peak" in peak oil is the point in time when oil production (i.e. extraction) is at its all-time high. The term Peak Oil refers to the maximum rate of the production of oil in any area under consideration, recognising that it is a finite natural resource, subject to depletion. — Colin Campbell The peak is directly below the light blue-green downward pointing arrow on the right hand graph below. This graph represents world oil production (i.e. extraction, which is almost the same as consumption since very little is ever stockpiled). The left hand graph (on the barrel) represents world oil discovery, which peaked in about 1962.

Once oil production has peaked (that is, "peak oil" has been reached) there is nothing that can be done to stop the decline in the rate at which the oil can be extracted (from existing/known sources). It is a matter of the physics of oil (and you can trust me on this, I have a first-class honours degree in physics) — it has nothing to do with economics or how high the price of oil becomes. Of course if more sources of oil are discovered, and the oil from these sources is added to the equation, then the peak can be shifted to later in time. However the peak of oil discovery has already occurred (it was in the early 1960s, a long time ago). See here for more about this. Why is Peak Oil Important to Know About?(There is a whole separate page about this, see here). Peak oil has massive consequences for modern industrial civilisation. You can read more about these here and here. The main reason for the severe impact peak oil will have (and already is having) is that all modern economies must continually grow or die (as in cease to exist) — and the limitations imposed by peak oil and other resource limitations mean that before too long after the peak, economic growth will no longer be possible. This is the main impact of the peak, the limit on economic growth. Peak oil does not mean that oil has "run out", and in fact it usually occurs at about the halfway point in the consumption of the resource. Meaning that about half the oil is still left in the ground when the peak occurs. However, we have a need for ongoing growth in oil production (to keep the economy growing, which it needs to do in order to keep existing). Once the peak occurs, oil gets much harder to get out of the ground — its not under pressure any more, the pressure drops, water has to be pumped in to flush out the oil, and other techniques are used to ge the oil out, which become more and more difficult as less oil remains. Some people claim that once the price of oil rises enough, this will allow for the greater costs in getting out this hard-to-get oil. However it's not about money, it's about energy. As our oil reserves become more depleted, we have to put in more and more energy to get a certain amount of oil out of the ground. This means that in effect, we get less and less net energy from the oil (since it costs increasingly more energy to get the same amount of oil). This is known as Energy Return on Investment (EROI). Once the EROI peaks, then less energy overall is available from the same amount of oil as before. Combining this with the fact that less oil itself becomes available each year after the peak, there is an overall decrease in oil energy available to the economy — and the modern economy has been built on the premise of having more oil energy available all the time, not less. The main points to be understood in all of the complicated and technical-looking graphs on this page are that peak oil is happening around now, plus or minus a few years, and it is going to bring about extreme changes to the world situation and to your own life. (Unless, perhaps, your own life is already so independent of the global economy that it won't be much affected, in which case it's unlikely that you would be on the internet reading this page.) If you want to know what you can do about this, and the changes that are ahead of us all, click here. There is a lot arguing over the finer points of peak oil, and if you search for "peak oil" on the internet it won't take long before you find hundreds of pages going on about this. However most of this is irrelevant in the big picture. The majority of our oil took about 80 million years to form (during the Carboniferous Period, which occurred from 360 to 280 million years ago), and we will have used up most of that 80 million years worth of trapped sunlight energy in the span of 100 years, from about 1950 to 2050 (and perhaps sooner than that). Whether the peak is 2008 or 2012 or even 2020 (which seems highly unlikely at this stage), this is not a large range of years compared to the history of the world. Peak oil is going to happen and its effects are fairly predictable. To quote Colin Campbell, "A debate rages as to the precise date, but misses the point when what matters is the vision of the long decline on the other side of it." Is Peak Oil "Real"?There are still some people in the media who refer to peak oil as being a theory. Peak oil was a theory when M King Hubbert first introduced the idea in 1956. However, peak oil stopped being a theory in the early 1970s, when the oil production of the United States peaked (exactly as Hubbert had predicted), and has since then continually declined. You can see this as the green shaded area at the bottom of the graph from ASPO below. (Also see here for more). Peak oil is no more a theory than the "theory" that the Earth is round and not flat like a pancake. The only real debate about peak oil is when the global peak will occur. The Date of Global Peak OilThere is a lot of opinion (and evidence) that the peak has already occurred (during the years 2005-2009), and that we are currently in what is called the "petroleum plateau" stage — which is the flattish bit at the top of the graph above. Global oil production (and consumption) has largely plateaued (i.e. stopped growing and flattened off), showing only a small overall rise since about 2005. Note that the numbers on the left side of the graph (representing the amount of oil, in millions of barrels per day) start at 60 at the bottom of the graph, which makes the graph look much more bumpy than it really is. (i.e. it would look much more flat if the scale started all the way down at zero barrels per day).

The graph below, which goes up to 2010, shows a mostly flat production curve from 2005 to 2010.

Even during the 2008 market crash, when the price of oil changed by about 3 times its value, the amount of oil used (and produced) globally barely changed at all. This is interesting and suggests that there is no more spare production capacity left to increase output in response to market changes.

The petroleum plateau (i.e. the flat spot at or near the top of the peak oil graph) can also be seen in the graph below, which spans a much greater number of years, going back to 1830.:

The same graph is shown again below, but with the different energy resources drawn as being stacked on top of each other. Oil is shown again in red — note that the equally rising slopes at both the top and bottom of the red coloured area on the far right of the graph mean that oil production has not changed much from 2005 to 2010.

What about the "new" oil that's being reported in 2012?Starting from 2012 there has been a lot of news appearing in the media suggesting that there is now a lot more oil available than previously thought, due to increases in technology allowing more difficult-to-extract oil (such as shale oil) to become available. This is good for the Dow Jones index and other market-based indicators, however it is unlikely that this "new" oil will be much help in delaying the effects of global peak oil. As an example of this news, in July 2012 the English Journalist George Monbiot wrote that in his opinion, these "new" oil resources mean that the global oil peak will occur much further into the future than he previously thought. His article was posted around the internet and in much of the world's mainstream media, including the Sydney Morning Herald. Several others wrote articles in direct response to his, which are interesting to read. Some of these can be read here, here, here, and here. Author Richard Adrian Reese wrote the following comments in response to Monbiot's article (emphasis added by myself): Last night I visited my 91-year old neighbor, Walter Youngquist, the petroleum geologist that wrote GeoDestinies, and one of the grandfathers of the Peak Oil discussion. He remains well-connected to the movers and shakers in the petroleum industry. One of his old students is the head of Exxon. When he saw that Monbiot was suggesting that the US may have more petroleum than Saudi Arabia, he strongly disagreed. Walt knows the geologist in charge of operations in North Dakota, and he knows the North Dakota state geologist. They understand reality far better than Monbiot. He said that the depletion rate on horizontal drilling was high. If a new well produces 3,000 barrels, production is likely to be 300 barrels a year later. He said that exploratory drilling in the Arctic was producing results far less than expectations. He acknowledged that new discoveries are being made, but their effect in delaying the peak of world production is trivial. “We’re heading for the cliff.” Richard Adrian Reese And geologist Colin Campbell wrote the following as a response to Monbiot's article (emphasis added by myself): I think at the heart of the Peak Oil issue is the need to properly define the different categories of oil and gas, each of which has its own endowment, costs, properties and depletion profile. I recognise the following: Below is a graph of world oil discovery (blue), production (green), and demand (red), from Richard Heinberg's Sydney talk in August 2006. The data is sourced from the US Energy Information Administration (EIA), British Petroleum (BP), and ExxonMobil. On this graph, "peak oil" is the top of the green area, occurring around now, with the decline beginning not long after the year 2010.

In the graph below, the data up to 2005 is historical, and the data after that is a projection made by ASPO in 2005. The actual world oil use since 2005 has remained pretty much flat, In other words, there has been a longer petroleum plateau, and a slower fall-off than this graph predicted.

As Colin Campbell says, "A debate rages as to the precise date [of peak oil], but misses the point when what matters is the vision of the long decline on the other side of it." ArchiveThe rest of this page is from an older version of the page, that I first wrote in 2006. As time marches on, and oil is consumed, and global demand grows, and spare capacity dwindles, the nature of the situation is becoming increasingly apparent—and increasingly well recognised. Here is a quote from ABC TV's Catalyst programme on peak oil, shown in November 2005: Earlier this year, Eric Streitberg asked an extraordinary question at the Australian Petroleum Production and Exploration Association conference. Eric Streitberg: I asked them to put up their hands if they thought that we had reached peak oil. Fifty percent of the people in the audience put up their hand saying that they believe we're at peak oil and these are practicing petroleum industry professionals. In other words, it looks like world oil production (that is, consumption) is about to peak about now, or within a small single-digit number of years from now. And then, it will go into terminal decline. Note that Eric is the Managing Director of an oil company, and he is coming out publicly to say stuff like this, as are many others around this time. I don't think that is going to do their share price much good. Retired and otherwise non-commercially-involved oil scientists and engineers have been talking about peak oil for many years now. But it is quite recent that this kind of information is being preached by currently practicing members of the oil industry, and even by oil companies themselves: Without any press conferences, grand announcements, or hyperbolic advertising campaigns, the Exxon Mobil Corporation, one of the world's largest publicly owned petroleum companies, has quietly joined the ranks of those who are predicting an impending plateau in non-OPEC oil production. Their report, The Outlook for Energy: A 2030 View, forecasts a peak in just five years..... The public should heed the

silent alarm sounded by the ExxonMobil report, which is more credible

than

other predictions for several reasons.

First and foremost is that the source is ExxonMobil. No oil company,

much less one with so much managerial, scientific, and engineering

talent, has ever discussed peak oil production before. Given the

profound implications of this forecast, it must have been published

only after

a thorough review. And we are seeing this topic discussed in more and more mainstream publications, for example Rolling Stone Magazine. You can read here about why economic growth is so important (to our modern society), and what will happen when it is no longer possible. For peak oil, one of the most convincing pieces of media that I have come across is Matt Savinar's first interview on "Feet to the Fire". The interview is the third segment in this stream, it begins at 1 hour, 09 minutes, and about 50 seconds from the start of the stream. It plays for about 40 minutes, plus an extra 20 minute "bonus" segment that was not part of the original radio broadcast. This interview is rather confronting. Why Is Peak Oil Such A Serious Problem? Share This Pageconventional crash decline economic economy energy gas global graph growth however known oil overall peak people petroleum production shale source tight video why world years Content is copyright © Survival.ark.au 2005-2025 All Rights Reserved. Terms of Use. Definitely read the disclaimer before trying anything from this website, especially including the practices and skills. This website uses affiliate links – this doesn't cost you any more, but I get a commission on purchases made through the website. As an Amazon Associate I earn similarly from qualifying purchases. |